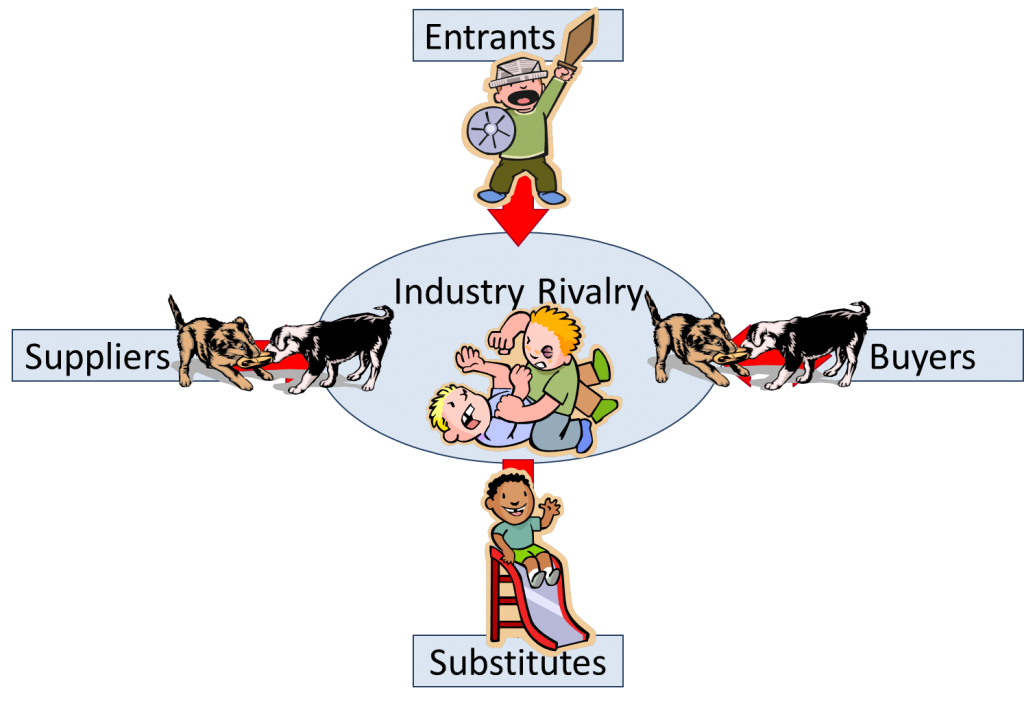

Five-Forces Analysis is an attempt to bring all the external factors which might influence the profitability of a company into a single conceptual frame. Invented by Michael Porter (and often called a Porter Analysis), the conceptual framework is usually depicted something like:

Our firm is situated at the centre of this picture, and is one of the members of the industry engaged in rivalry. Because a Five-Forces Analysis sees the relationship with Suppliers and Buyers as a tug-of-war over the profits available in transactions, it’s probably more accurate to show those arrows as bi-directional. And, because the effect of substitutes is to pull buyers away from our industry, that arrow should probably go in the opposite direction:

According to Porter, all five forces (entrants, suppliers, industry rivalry, buyers, and substitutes) exert downward pressure on a firm’s profits. The stronger a force acting on our firm, the lower our profits are likely to be. And, conversely, the more we can reduce the forces acting on us, the higher our profits are likely to be. In this framework, struggles for profits are, in effect, struggles for power. And every firm is engaged in five of them:

Although, like all strategy tools, this one has flaws and limitations, for companies struggling to become (or remain) profitable, it has three key benefits:

- it can help planners understand the causes of their profit problems

- it can help planners and managers understand where to focus their actions

- it can help guide the choices they make within the area they have chosen to focus on

Analyzing the Forces

Each of the five forces have two types of characteristics−product characteristics and relationship characteristics. A list of factors within each of these forces that can be expected to increase competitive pressure on our firm (and, as a result, put downward pressure on our profits) is listed below. This list is not intended to be definitive. Instead, it’s a starting point for us to begin to understand the pressures experiences.

Suppliers

- differentiated product

- input essential

- no substitutes

- high switching costs

- customers care about source materials

Relationship Characteristics

- fewer suppliers than buyers

- our suppliers have more important customers

- suppliers have forward integration potential

- supplier’s viability is under threat

- suppliers involved in industry for reasons other than profits

Buyers

- volume purchases

- big ticket items

- standardized product

- low switching costs

- low profit margins

Relationship Characteristics

- fewer buyers than sellers

- purchase not as important as sale

- buyer has all relevant information

- buyer has backward integration potential

- buyers making purely rational purchases

Entrants

Product Characteristics

- minimal economies of scale

- low differentiation

- low capital requirements

- low switching costs

- little proprietary technology

Relationship Characteristics

- low product, experience or brand loyalty

- easy access to distribution channels

- little government policy intervention

- high-prestige industry

The phrase “low barriers to entry” is derived from this part of five-forces analysis. If our industry has the entry conditions listed above, it’s easy for a new company to enter our industry−either as a start-up, or as an established company deciding to enter our market. There are no barriers to entering our market, increasing competition, and driving down profits.

The recommended response to finding yourself in an industry with low barriers to entry to to try to raise the barriers by changing one or more of the conditions listed above. Quite often, firms do this by setting up regulatory hurdles, either through government or through industry-regulating bodies.

This force, and firms’ reactions to it, helps explain why highly-regulated industries tend to be more profitable than less-regulated industries.

Substitutes

Product Characteristics

- low switching costs

- products are comparable in price, quality, and experience

Relationship Characteristics

- low-touch selling relationship

- customers view relationship as commercial

Industry Rivalry

Product & Production Characteristics

Product & Production Characteristics

- slow growth

- low demand

- low differentiation

- high stakes

- harge capacity increments

- high fixed costs

- high exit barriers

Relationship Characteristics

- numerous rivals

- rivals equally balanced

- low switching costs

- diverse competitors

- customer taste in flux

- non-rational industry participants